General Accounting

|

|

Odoo |

QuickBooks

|

Sage |

Xero |

| General Scope | ||||

| Multi-Currency system | ✔ | ✔ |

✔

|

✔

|

| Consolidation |

✔

1

|

✘

|

✘

|

✘

|

| Multi-User | ✔ | ✔ | ✔ | ✔ |

| Multiple Journals | ✔ | ✔ | ✔ |

✘

|

| Number of Languages |

85

|

5 | 10 | 1 |

| Supported Countries

2

|

80+

|

1 | 15 | 5 |

| Access Rights | ||||

| Access Rights per Screen |

✔

|

✔ |

✔

|

✘

|

| Access Rights per Field |

✔

|

✔

|

✔

|

✘

|

| Customizable Validation Steps |

✔

|

✘ |

✘

|

✘

|

| Third Party-Integration | ||||

| Availability of an API |

✔

|

✔

|

✔

|

✔

|

| Spreadsheet Integration |

✔3

|

✘4 |

✔

|

✘

|

| Import: Excel or CSV |

✔

|

✔

|

✔

|

✔

|

| Export: Excel or CSV |

✔

|

✔

|

✔

|

✔

|

| Customer Portal |

✔

|

✔

5 |

✔

|

✘

|

1 - Odoo Consolidation is available on testing.

2 - QuickBooks is dedicated to the U.S. market. Xero is supported in 5 countries: Australia, New Zealand, US, South Africa, and the UK. Sage Business Cloud Accounting is available in 15 countries: Australia, Botswana, Brazil, Canada, Germany, Ireland, Kenya, Malaysia, Morocco, Namibia, Nigeria, South Africa, Switzerland, UK, and the U.S.

3 - Available with Odoo Studio (extra price).

4 - Integrated with MS Excel.

5 - Add-on required for this feature

Accounts Receivable

|

|

Odoo |

QuickBooks |

Sage |

Xero |

| Customer Invoice | ||||

Proforma Invoices | ✔ | ✔ | ✔ | ✘ |

| Multiple Taxes per Line |

✔ | ✘ |

✔

|

✘

|

Advanced Taxes (fixed, tax of taxes, etc.) | ✔ | ✘ | ✔ | ✘ |

| Discounts |

✔

|

✔ |

✔

|

✔

|

Pricelists | ✔ | ✔ | ✔ | ✘ |

Multi-Step Payments Terms | ✔ | ✘ | ✔ | ✘ |

Cash Discounts | ✔ | ✘ | ✘ | ✘ |

| Outstanding Payments Reconciliation |

✔

|

✔ | ✔ |

✔

|

| Emails Discussion as Attachment |

✔

|

✘

|

✘

|

✘

|

| Configurable Email Templates |

✔

|

✔

|

✔

|

✔

|

| Send Invoices | ||||

| Generate a PDF Invoice | ✔ | ✔ | ✔ |

✔

|

| Batch Send Invoices by Email |

✔

|

✘

|

✔ |

✔

|

| Post Invoices by Standard Mail |

✔

|

✔ |

✘

|

✘ |

|

Online Payments

|

||||

| Credit Cards |

✔ |

✔1 |

✔ |

✔

|

| PayPal |

✔

|

✔

|

✔

|

✔

|

| SEPA Direct Debit |

✔

|

✘

|

✔

|

✘

|

|

Customer Statements

|

||||

| Aged Receivable Balance |

✔

|

✔

|

✔

|

✔

|

| Customer Statements |

✔

|

✔

|

✔

|

✔

|

| Automated Follow-up Letters |

✔

|

✘

|

✘

|

✔

|

Automated Follow-up Actions | ✔ | ✔ | ✘ | ✔ |

Unpaid Fees and Penalties 1 | ✔1 | ✔ | ✘ | ✘ |

Third-Party Debits Recovery | ✘1 | ✘ | ✔ | ✔ |

| Recurring Revenues | ||||

| Automated Recurring Invoices |

✔

|

✔

|

✔

|

✔

|

| Subscription Upsell / Renewal |

✔

|

✔

|

✘

|

✘

|

| KPIs: Churn, MRR, Upsells, etc2

|

✔

|

✘

|

✘

|

✘

|

| Alerts for Contract Renewal |

✔

|

✘ |

✔

|

✘

|

| Miscellaneous | ||||

| Automated COGS Entries |

✔

|

✔

|

✘

|

✘

|

| Automated Deferred Revenue |

✔

|

✘

|

✘

|

✘

|

1 - Included for an additional fee.

2 - Available with Community module.

3 - Such as MRR, Chrun, CAC Ratio, CLTV, etc. It's about recurring KPI, not custom KPI.

Accounts Payable

|

|

Odoo |

QuickBooks |

Sage |

Xero |

| Vendor Bills | ||||

| Billing Control (Purchase Orders / Receptions) |

✔ | ✔ |

✘

|

✘1

|

| Multiple Taxes per Line |

✔

|

✘

|

✘

|

✘1

|

| Purchase Agreements |

✔

|

✘

|

✘

|

✘

|

| Multi-Step Payment Terms |

✔

|

✘ |

✔

|

✘

|

| Fleet Bills & Disallow Expenses |

✔

|

✘ |

✔

|

✘

|

| Peppol / UBL Support |

✔

|

✘ |

✔

|

✘

|

| Artificial Intelligence | ||||

| Bills OCR Recognition | ✔ | ✔ | ✔ |

✘

|

| Learning Intelligence |

✔

|

✘

|

✘

|

✘

|

| Payment Date from OCR |

✔

|

✘

|

✘

|

✘ |

| Realtime OCR (<10 minutes) |

✔

|

✘

|

✘

|

✘

|

| Vendor Payments | ||||

| Aged Payable Report | ✔ | ✔ | ✔ |

✔

|

| Print Checks |

✔

|

✔

|

✘

|

✔

|

| Automate Wire Transfer (SEPA) |

✔

|

✘

|

✔

|

✘

|

| ACH Transfers |

✔

|

✘2

|

✘

|

✘1

|

| Expenses | ||||

| Employee Expenses Report | ✔ |

✘1

|

✘

|

✔

|

| Expenses Validation Flow |

✔

|

✘

|

✘

|

✔

|

| Mobile App for Expenses | ✔ |

✔

|

✘

|

✔

|

| Miscellaneous | ||||

| Assets Management |

✔

|

✔

|

✔

|

✔

|

| Bank & Cash | ||||

| Bank Interfaces |

✔ |

✔

|

✔

|

✘

|

Import Statements: QIF | ✔ | ✔ | ✔ | ✔ |

Import Statements: OFX | ✔ | ✔ | ✔ | ✔ |

Import Statements: CSV | ✔ | ✔ | ✔ | ✔ |

Import Statements: Coda | ✔ |

✘ |

✘ | ✘ |

Import Statements: Camt.053 | ✔ |

✘ |

✘ | ✘ |

Deposit Tickets | ✔ | ✔ | ✔ | ✔ |

|

Efficiency

|

||||

| Reconcile while Matching |

✔ |

✔

|

✔

|

✔ |

Misc. Operations while Matching | ✔ | ✔ | ✔ | ✔ |

Automated Rules | ✔ | ✔ | ✔ | ✔ |

Bank Reconciliation Reports | ✔ | ✔ | ✔ | ✔ |

Automated Currencies Rate Update | ✔ | ✔ | ✔ | ✔ |

1 - Available with add-on.

2 - Available with Quickbooks Payments.

3 - Available with QuickBooks Online Payroll.

Extras

|

|

Odoo |

QuickBooks |

Sage |

Xero |

|

Analytic Accounting / Grouping

|

||||

| Analytic / Cost Accounting | ✔ | ✔ |

✔

|

✔ |

| Multi-Level Analytic Accounting | ✔ |

✘

|

✘

|

✘

|

| Multiple Plans | ✔

|

✘

|

✘

|

✘

|

| Budgets | ||||

| General Budgets | ✔ | ✔ | ✔ |

✔

|

| Analytic Budgets |

✔

|

✔ |

✘

|

✔

|

| Payroll | ||||

| Payroll |

✔1

|

✔1

|

✔ |

✔

|

| Valuation | ||||

| Standard Price |

✔

|

✔

|

✔

|

✘2

|

| Average Price | ✔ |

✔

|

✔

|

✔

|

| FIFO |

✔

|

✘3

|

✘

|

✘2

|

| Perpetual Inventory Valuation |

✔

|

✘3

|

✘

|

✘

|

1 - QuickBooks offers import of payroll tax tables for an additional fee.

2 - Available with add-on.

3 - Available with QuickBooks Online PLUS.

4 - Odoo includes a payroll engine, but not useable out-of-the-box as it requires heavy configurations.

Reporting

|

|

Odoo |

QuickBooks |

Sage |

Xero |

|

Legal Statements

|

||||

| Profit and Loss | ✔ | ✔ |

✔

|

✔ |

| Balance Sheet |

✔

|

✔ |

✔

|

✔ |

| Cash flow statement |

✔

|

✔ |

✔

|

✔

|

| General Ledger | ✔ | ✔ | ✔ |

✔

|

| Tax Reports |

✔

|

✔ |

✔

|

✔

|

| Tax Audit Report | ✔ | ✔ |

✘

|

✔

|

| Reports | ||||

| Pivot Table on Multiple Dimensions |

✔

|

✔

|

✔

|

✘

|

| Customizable Reports | ✔ |

✔

|

✘

|

✔

|

| Customizable Dashboards | ✔ |

✔

|

✔

|

✔ |

| Annotate Reports |

✔

|

✘

|

✘

|

✔

|

| Customizable KPI's |

✔

|

✘

|

✘

|

✔

|

| Predefined Executive Summary |

✔

|

✔

|

✘

|

✔

|

| Perpetual Fiscal Year Closing |

✔

|

✘

|

✘

|

✔ |

Usability, Pricing & Conditions

|

|

Odoo |

QuickBooks |

Sage |

Xero |

| UI | ||||

Full Web Interface | ✔ | ✔ | ✔ | ✔ |

| Mobile App |

✔ | ✔ |

✔

|

✔

|

Android App | ✔ | ✔ | ✔ | ✔ |

| iPhone App |

✔

|

✔ |

✔

|

✔

|

|

Market Place

|

||||

| App Store / Add-ons |

✔ | ✔ | ✔ |

✔

|

|

Other (integrated) solutions

|

||||

| eCommerce |

✔ |

✘1 |

✘

|

✘

|

| Expenses |

✔

|

✔

|

✘

|

✔

|

| Inventory |

✔

|

✔

|

✔

|

✔

|

Manufacturing | ✔ | ✘ | ✔ | ✘ |

Operations (project, timesheet, etc.) | ✔ | ✔ | ✘ | ✔ |

Human Resources | ✔ | ✘ | ✔ | ✘ |

Document Management | ✔ | ✘ | ✘ | ✔ |

Subscriptions | ✔ | ✘ | ✘ | ✘ |

Point of Sale | ✔ | ✔ | ✘ | ✘ |

Purchase | ✔ | ✔ | ✔ | ✔ |

Sales | ✔ | ✔ | ✔ | ✔ |

|

Subjective Ratings

|

||||

| Navigation and Search |

5/5 |

4/5 |

3/5 |

5/5 |

| Data Entry |

5/5 |

4/5 |

4/5 |

5/5 |

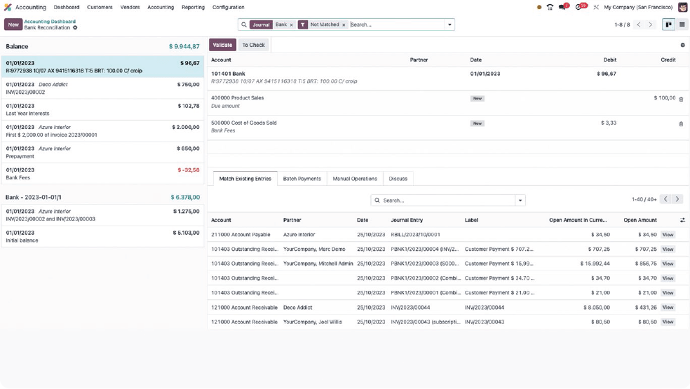

| Reconciliation Tool |

5/5 |

3/5 |

4/5 |

5/5 |

Mobile App | 4/5 | 4/5 | 3/5 | 5/5 |

Reports Flexibility | 4/5 | 4/5 | 3/5 | 4/5 |

|

Pricing and Conditions

|

||||

| Monthly Pricing |

Free1 |

27$

|

10$

|

30$1

|

| Number of Users |

Unlimited

|

32

|

Unlimited

|

53

|

| Contract Duration |

Monthly |

Yearly

|

Monthly

|

Monthly

|

| Free Trial |

✔

|

✔ |

✔

|

✔

|

|

User Satisfaction

|

||||

| Rating on g2Crowd |

4.3/5 |

4/5 |

3.8/5

|

4.3/5 |

| Rating on GetApp |

4.2/5 |

4.3/5

|

3.8/5 |

4.4

/5 |

Rating on Capterra | 4.1/5 | 4.3/5 | 3.8/5 | 4.4/5 |

Brand Exposure | 3/5 | 5/5 | 3/5 | 4/5 |

1 - Integrated with Shopify and WooCommerce.

2 - Xero costs $70 per month if you need multiple currencies. Available with QuickBooks Payments

3 - +2 accountant users.

4 - +1$/month for each additional user.

5 - Odoo Accounting is free for unlimited users, as long as you use solely the Accounting app. Access ALL Odoo Apps for only 24,90€/user/month.

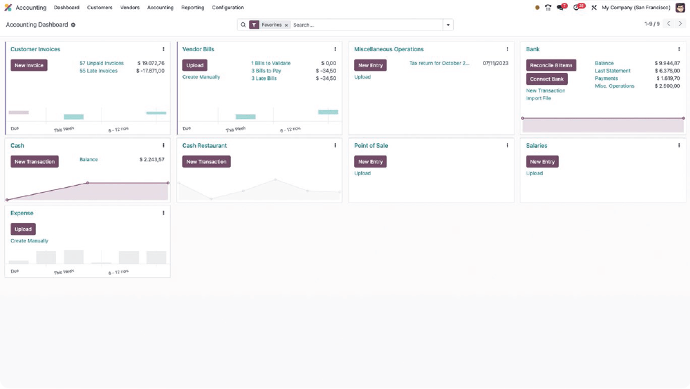

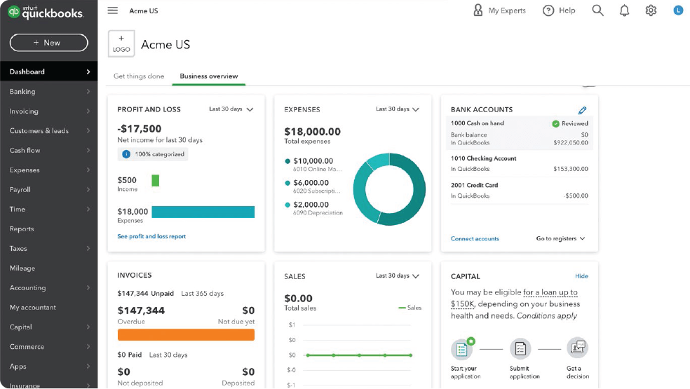

User Interface

Regarding efficiency and end-user satisfaction, fine-tuned usability is one of the most important factors in any software platform. This is especially true for accounting software, given that users often dedicate the majority of their time working within the application. To provide functionality, speed, and convenience to an accounting team, a software solution must maintain a balance between ease of use and a robust set of features. A strong functional design is then critical in providing a positive user experience and optimizing user efficiency.

Usability is qualitatively measured as the ability to anticipate a user's potential

actions and needs. This includes ensuring that all the elements in the interface

are easy to access, understand, and use. Well-designed software establishes

familiarity by maintaining a consistent interface and predictable interactions,

so users feel comfortable with the system, which will allow them to complete

their desired tasks quickly. This aids users in executing actions swiftly and

enhances their overall efficiency in their daily tasks. Best practices also

include having a simple and consistent interface (common elements), as well

as a page layout based on hierarchical importance and flow.

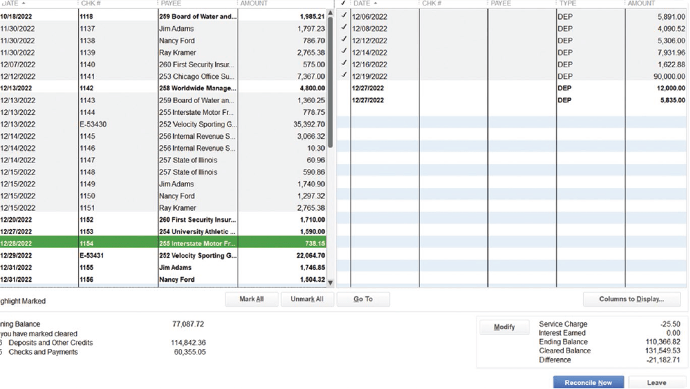

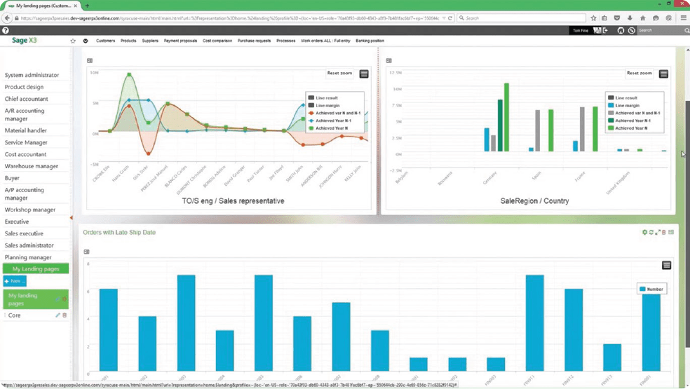

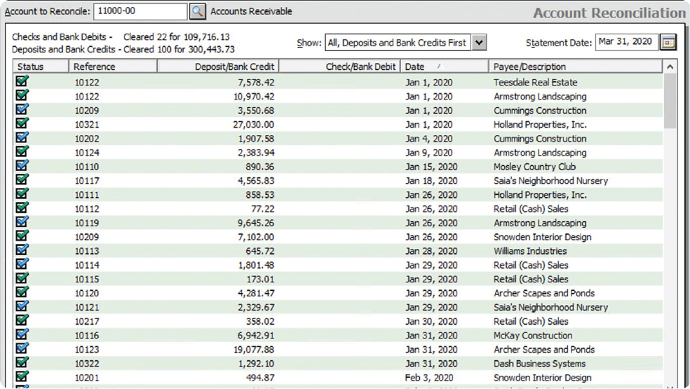

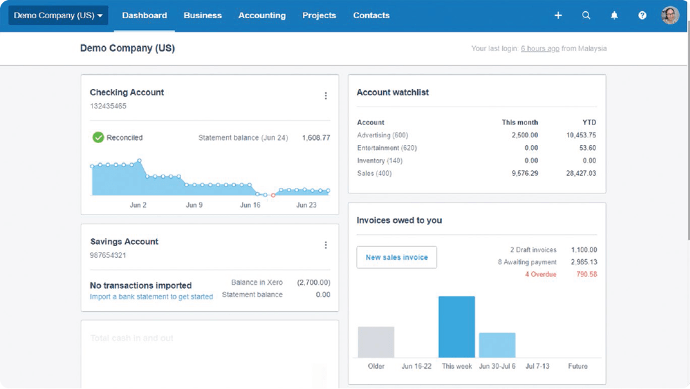

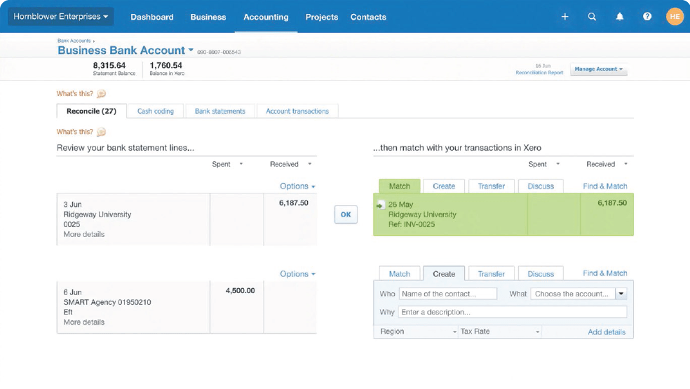

In the next section, we will take a look at screenshots of the back-ends of these four products to compare the layouts of their Dashboards and Bank Reconciliation interfaces.

Dashboard |

Bank Reconciliation |

|

Odoo |

|

|

QuickBooks |

|

|

Sage |

|

|

Xero |

|

|

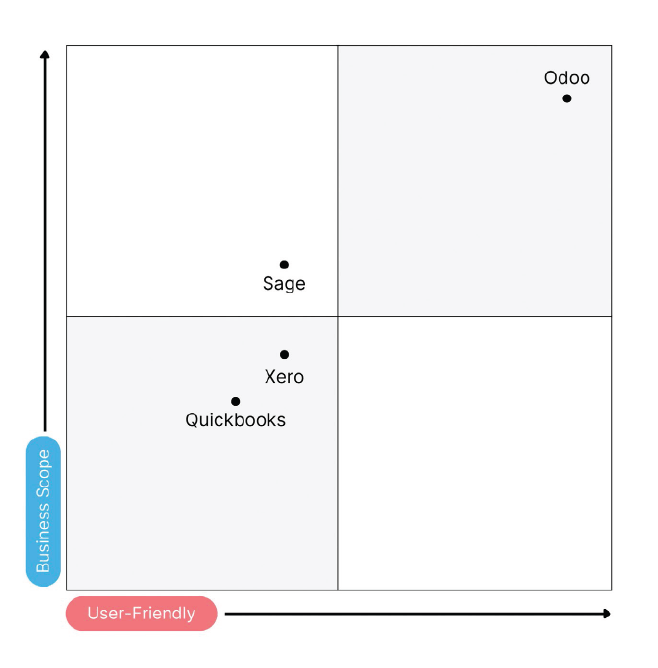

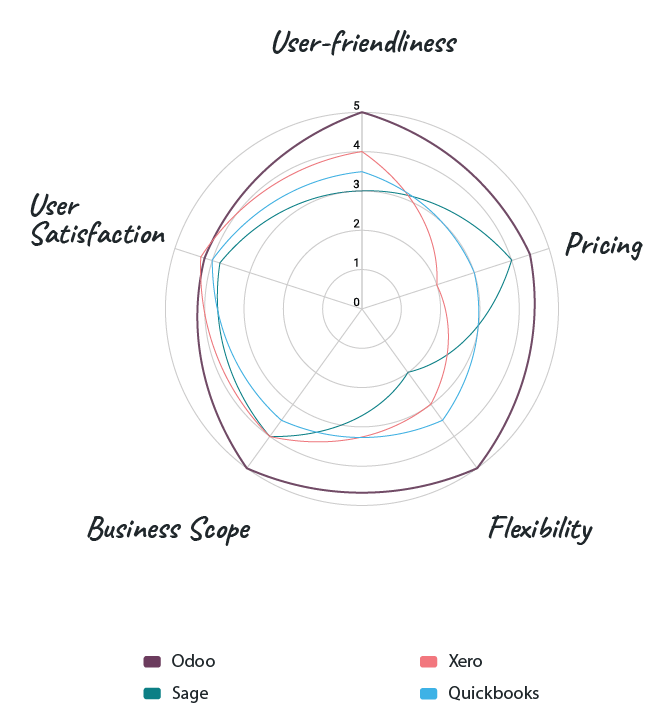

Different solutions, Different needs

When choosing the right software for your business, it is important to assess several criteria based on your specific needs.

Business Scope measures a software’s capacity to meet your business needs comprehensively through its features and its flexibility in customizability and integration with other tools. User-Friendliness measures how straightforward and user-friendly a software solution is for your team to navigate, requiring minimal training or complex procedures. Additionally, it evaluates how hassle-free the software is to set up, considering factors like time, effort, and resource requirements for initial configuration within your organization. |

|

Odoo is a robust solution addressing a wide range of business needs, extending beyond accounting functions. The platform is designed to streamline operations and replace the need for disjointed, non-integrated software applications. Odoo shines as a highly customizable, all-in-one solution with a multitude of applications. Its open-source nature empowers a thriving community, resulting in a vast repository of community-contributed applications. Compared to its competitors, which lack certain crucial features, Odoo provides a high-quality bill management solution. Sage provides a comprehensive solution with advanced accounting features but may encounter limitations in terms of customization. Additionally, Sage offers a wide range of other business solutions, including payroll, people management, and more. In the realm of integration, Sage offers robust inventory reporting, which facilitates efficient tracking and management. This capability aids your business in controlling asset value and making informed decisions. Xero and Quickbooks are considered out-of-the-box solutions. Both

solutions offer specialized accounting software but are lacking more

advanced features. They don’t provide an all-in-one solution for businesses

aiming to extend beyond accounting. However, Xero offers comprehensive

estimating and invoicing, allowing users to quickly generate precise invoices,

improving cash flow management and billing processes. | In terms of user-friendliness, Odoo provides intuitive interfaces, making the solution suitable for users with diverse technical backgrounds. The straightforward setup ensures a hassle-free experience for every business. Quickbooks, Sage, and Xero, on the other hand, are considered less user friendly and can be challenging to set up. Their interfaces might require more time and effort for users to become familiar with them. Sage’s system might be difficult for non-accountants to navigate the system, while Quickbooks suffers from a lack of direct professional support and system crashes, making the product hard to use for daily operations. This is why it’s important to consider the specific needs and scale of your business when assessing which solution is the best fit, as the ease of use and setup can vary significantly among these options. |

Value Proposition

Conclusion

Ultimately, the choice depends on your organization’s unique needs, scale,

and the balance needed between customization, ease of use, and setup.

If you are in search of a specialized accounting solution, then Odoo, Xero,

Sage, and Quickbooks could be a good fit. With their advanced accounting

features, these systems are particularly well-suited for complex accounting

environments and provide efficient solutions for every accounting needs.

If you have more extensive requirements, you may find Odoo as the most

appealing solution. Its advanced features can accommodate any process.

The possibilities in terms of customization and the extensive suite of

integrated business applications make it the best solution for businesses

with requirements beyond accounting. Furthermore, Odoo excels in

user-friendliness and ease of setup, making it a suitable choice for small

and medium-sized businesses.

So whether you are a small startup comparing accounting solutions for the first time or a large enterprise thinking about changing your current software, the information in this document is a good tool to compare the most important aspects of each accounting solution to find the software that best works for you.

This comparison was compiled by Odoo SA. We did our best to make it objective and fair based

on the information available online. If you find mistakes or missing features, please report it to

whitepapers@odoo.com and we will update the online version. Our goal is to have a continuously

updated comparison of the main competitors to be as accurate as possible.